Every year, hundreds of thousands of Americans and businesses face financial distress severe enough that bankruptcy becomes not just an option, but a real solution. According to national research, nearly 500,000 bankruptcy cases are filed annually across the United States — and that figure includes both individuals and businesses seeking relief through the federal courts. … Read more

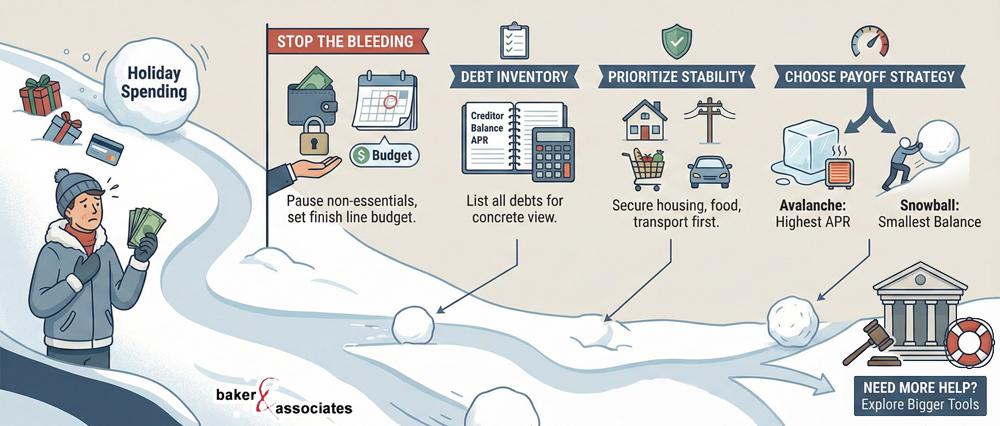

Between gifts, travel, school breaks, and “we’ll figure it out later,” it’s easy for holiday spending to quietly turn into January panic. And with credit card interest rates still hovering around the mid-20% range for many borrowers, balances can grow faster than people expect. If you’re feeling that familiar “debt hangover,” here are a few … Read more

Life can throw an unexpected curveball — a sudden job loss, a medical emergency, or a severe downturn in business can leave you scrambling to keep up with payments, calls from creditors, and confusing financial decisions. If you’re considering filing for bankruptcy (whether under Chapter 7, Chapter 13, or another option) but haven’t filed yet, … Read more

If you’re reading this, chances are you or someone you know is facing serious financial pressure—and turning to bankruptcy may feel like the only viable option. At Baker & Associates, we recognize that bankruptcy is a major decision, but it doesn’t have to mark the end of your credit future—it can be the beginning of … Read more

When people hear the word bankruptcy, they often picture something dramatic — losing everything, walking away in shame, or never being able to buy a home again. The truth? Bankruptcy is often a lifeline, not a punishment. If you’ve ever wondered whether it might help you or a loved one, let’s bust a few common … Read more

Many of our recent posts have covered critical debt issues — such as managing credit card debt, navigating job-related financial strain, and understanding bankruptcy basics and the power of the automatic stay. Now, with important changes to bankruptcy thresholds taking effect on April 1, 2025, there’s even more to consider. What’s Changing on April 1, 2025? … Read more

High-interest credit cards can turn manageable expenses into overwhelming debt. What begins as a temporary solution—covering emergencies or making ends meet—can quickly spiral into a financial crisis. One powerful tool designed to give people a fresh start. Stops Collection Calls and Lawsuits As soon as you file for bankruptcy, an automatic stay goes into effect. … Read more

Losing a job can feel overwhelming. Beyond the emotional impact of facing an uncertain future, the financial strain can cause major stress. One of the greatest concerns is the potential for falling into debt while you’re trying to figure things out. However, with the right strategies, you can navigate this tough time without accumulating debt. … Read more

Bankruptcy can be a complex legal process that varies significantly depending on where you live. Generally, the ease of filing for bankruptcy depends on several factors: Type of Bankruptcy: There are different types of bankruptcy filings, such as Chapter 7 and Chapter 13 in the United States, each with its own eligibility criteria and process. … Read more

The automatic stay is one of the most powerful features of bankruptcy, offering immediate protection from creditors and debt collection actions. Once you file for bankruptcy, the automatic stay goes into effect automatically, providing relief in several ways: Stops Collection Calls and Harassment The automatic stay immediately halts collection calls, threatening letters, and harassment from … Read more