When some people think of bankruptcy, they think of dishonest people who rang up a bunch of bills and then don’t want to pay for them. Or that people lived foolishly and now are stuck with the fallout of too much debt. The Truth About Bankruptcy The reason we have the bankruptcy laws is to … Read more

While it’s true, bankruptcy can show up on your credit report for up to 10 years, but bankruptcy is certainly not the only thing that can damage your credit rating. Falling behind or avoiding making payments can also negatively impact your credit score. Other reasons for negative hits to your credit report include foreclosures, court judgments, … Read more

Getting out of debt can be difficult. You will have to develop a plan and stick to it if you want to pay down or get out from under the crushing weight of too much debt. Limit Credit Cards If you are unable or unwilling to get rid of your credit cards, at least stop using … Read more

You have two options when filing personal bankruptcy, Chapter 7 or Chapter 13, named for the codes in the bankruptcy law they represent. Businesses and farmers have different types of bankruptcy rules. Chapter 7 Chapter 7 is the most basic form of bankruptcy. It allows you to eliminate or “discharge” certain debt. When you have … Read more

The 341 meeting, named for the Bankruptcy Code section that regulates it, is a meeting with you, your lawyer, your creditors, and the appointed bankruptcy trustee. This meeting occurs approximately thirty days after filing your bankruptcy petition with the court. Your Financial Information Reviewed The bankruptcy trustee will usually take 15 to 30 minutes to … Read more

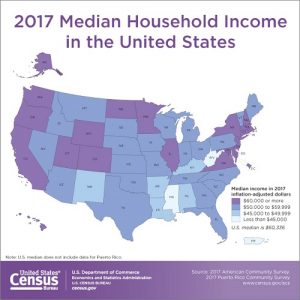

The bankruptcy abuse prevention and consumer protection act of 2005 require individuals to take a “means test” to determine if they can file Chapter 7 bankruptcy. The test determines if the personal income is low enough to file Chapter 7 bankruptcy. The law was designed to keep high-income filers from filing Chapter 7 and eliminating … Read more

One of the most common reasons noted for filing personal bankruptcy is unemployment. Of course, it’s difficult if not impossible to pay your bills if you have little to no money coming in. As many as 2/3 of Americans list job-related financial stress as the reason for filing personal bankruptcy. While having six months of … Read more

Filing bankruptcy can give you a fresh start and the ability to rebuild your finances and create better financial habits. When you remove the overwhelming debt and begin to make sound financial choices over time, your credit score will improve, and it will be easier to obtain creditworthiness for loans and large purchases. Avoid Easy … Read more

Also known as, regular bankruptcy, straight bankruptcy or liquidation bankruptcy, Chapter 7 is bankruptcy in the most basic form. Chapter 7 allows you to discharge or cancel certain debt, with no repayment plans. Debts that can typically be discharged include medical, auto, rent, utilities and some credit card debt. You must give up any of … Read more

Before an individual can file for bankruptcy, they are now required to complete credit counseling. The purpose of this is to weigh your options of dealing with your debt, including repayment plans and bankruptcy. Since the credit counseling industry was mainly the idea of lenders, and those lenders still provide financial support for credit counseling … Read more